Good morning,

I’ve a question about the calculation of capital gains when it comes to liquidity pools in Defi protocols. I’ve read your article here LP tokens and liquidity pools | Coinpanda Help Center

If I got it correctly, providing/removing funds from LP is treated as taxable event and indeed I found them in my tax report. Am I right?

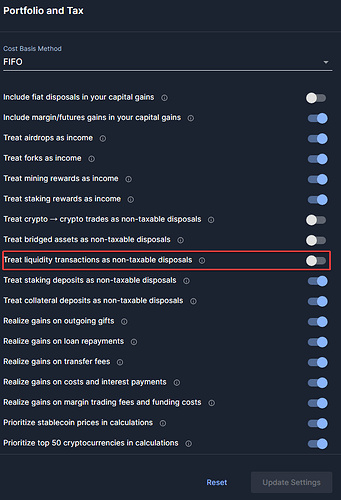

However, in Italy the new regulation states that crypto-to-crypto trades are not taxable events, so for example gain/losses in a BTC-ETH LP should not be included. How could I manage this isse?

Best,

Gianluca