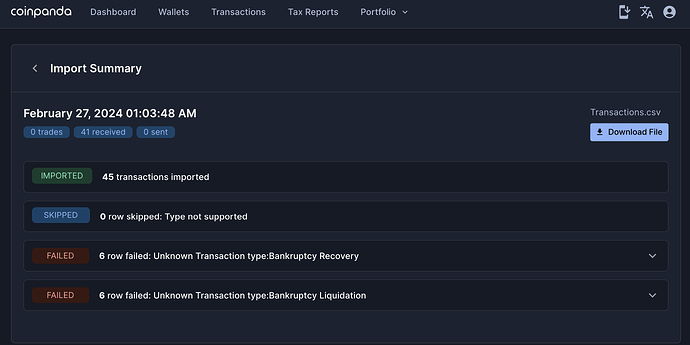

Due to the Voyager bankruptcy I had a capital loss this year that I want to make sure I document on my taxes. The .csv file that I got off of CoinLedger with all of my transactions is not compatible with TurboTax. They have their own format, and I’m not sure how to manage the transaction types labled as “bankruptcy recovery” and “bankruptcy liquidation”. I tried to create a tax document using CoinPanda and it failed to load the lines with those transaction types, which were not recognized. I think I really only need a capital gains/losses document, but I don’t know how to get that or where I would enter that in Turbo Tax. Would love a solution to this issue!

Hi there

Bankruptcy related transactions are currently not imported. You will need to consult a Tax professional to advise you on how these should be handled in your crypto tax report.

You can contact support directly if you need assistance with importing these transactions via a Generic CSV file

Thank you for your reply. This is a totally new world to me so may need further clarity to fully understand. How can I get a gains/losses report if coinpanda will not accept/import bankruptcy related transactions? The only way I even know what my losses are (due to voyager bankruptcy) is CoinLedger had a dashboard, but even the csv file that you can download from them doesnt show the appropriate transactions to fully track the capital loss in this case. It seems like everything is hidden behind a paywall and it doesnt feel ethical that I should not have free access to my own data about my own accounts! They keep trying to get me to pay $50 for a report (like a form 8949, or whatever the gains/losses report his), but I can build the report myself when I have the data about my account. Anyone can download a form 8949 online! Do you know how I can access my own data? Also do you know what the gains/losses report is called?

I feel like i am not the only one going through this situation, and surely someone on this forum knows how to handle this tax situation so that not every single one of us has to actually consult a tax professional. once a few people have consulted a tax professional, they can simply share how and where you report that information in TurboTax, TaxSlayer, etc.

Thanks again for your insights!

Unfortunately bankruptcy related transactions are currently not imported. You will need to consult a Tax professional to advise you on how these should be handled in your crypto tax report. So, you should ask them for help just to make sure everything is perfect. We can’t help you directly with bankruptcy transactions.

You can however, create send transactions on a generic CSV template and then tag it as lost. So that way, Coinpanda will accurately calculate that those tokens were lost such as in a bankruptcy situation.

I can’t answer questions about other crypto tax calculator softwares, just because, I am not familiar with them. I am only familiar with Coinpanda. The report that is sounds like you are looking for would be called, Capital Gains Report. At Coinpanda we call it, Capital Gains CSV.

Hi there,

These Voyager transactions related to bankruptcy can be imported now. Support was added in the latest round of CSV integration updates